• Performing loan volumes increased by 20% compared to the same period of last year, supported by SMEs lending, real estate lending and corporate credit dynamics;

• Deposits volumes registered an increase of 15% compared to the first quarter of 2019;

• First quarter results show a 10,7 million lei loss, due to extra risk provisions related to the pandemic context.

OTP Group announces the financial results for the first quarter of 2020. According to the report published in Budapest, which presents the consolidated results adjusted in accordance with the Group´s standards, OTP Bank România has registered a loss of RON 10,7 million (HUF 0,9 billion) in the first three months of the year. The evolution was influenced by the threefold increase of risk costs, in the context of the Covid-19 epidemic.

Operating profit of the first three months of the year decreased slightly, at 36 million lei, HUF 2,5 billion), following the increase of 12% in total income, compared to the same time frame of last year, but also following a 18% increase in operating expenses, due to implementing the organic development program of OTP Bank România, started in 2019.

The net interest income improved in the first quarter by 24% y-o-y. The growth was supported by the dynamic development of the high-performing loan portfolio and by the improvement of interest margins.

The performing loan volumes, FX-adjusted, increased by 20% in the first three months, supported by SMEs lending (+30%), robust mortgage demand (+22%), and corporate lending increase (+15%). The economic context generated by the Covid-19 epidemic also determined the reclassification and careful analysis of loans in the bank's portfolio.

Lending activity has been strongly supported in the first quarter of 2020, and new sales of real estate loans have grown by 25%, while the growth rate of loans for customers in the Corporate segment increased by 27%.

FX-adjusted deposit volumes increased by 15% y-o-y. The dynamic has been fuelled by three business lines: Retail (+17%), SMEs (+9%) and Corporate (+19%).

According to local regulations, the Bank´s standalone total assets posted 13,2 billion lei, increasing by 17% compared to the end of March 2019, while the after-tax profit was of RON 22 million. The capital adequacy ratio of the bank increased to 18,9%, from 17,2% in the first quarter of last year, following the capital increase of 320 million lei, done by OTP Bank PLC in September 2019.

In the first quarter of 2020 OTP Group has registered an adjusted after-tax profit of HUF 31,832 billion (RON 450 million). 1 Q 2020 results were shaped mainly by the surging risk costs due to the assumed negative impact of the coronavirus. The consolidated accounting loss was HUF 4 billion (RON 58 million).

Profit contribution of OTP Core – Hungary (HUF 16,871 billion / RON 239 million), DSK Bank in Bulgaria (HUF 4,411 billion / RON 62 million), the Croatian operation (HUF 2,646 billion, RON 37 million), the Ukrainian (HUF 6,658 billion / RON 94 million) and Serbian subsidiaries (HUF 1,746 billion / RON 25 million).

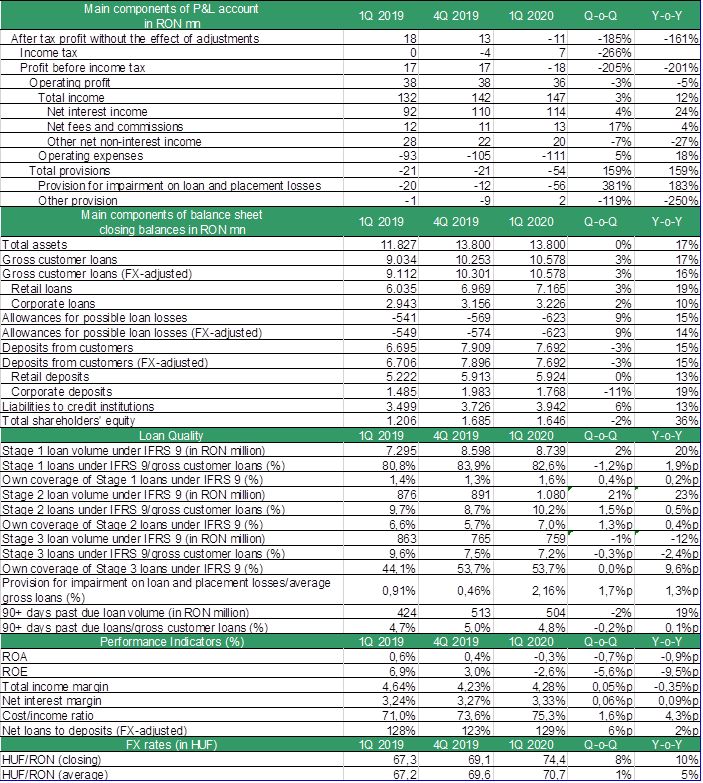

The full results of OTP Bank Romania are presented in the table below.

The full report published by OTP Bank Plc. is available here: https://www.otpbank.hu/static/portal/sw/file/OTP_20201Q_e_final.pdf.

About OTP Bank Romania

OTP Bank Romania, a subsidiary of OTP Group, is an integrated and self-financed provider of financial services. With an approach defined by responsibility, commitment and professionalism, OTP Bank Romania understands the needs of clients and the current context of the market and is a trusted partner in the provision of financial services. The bank ranks 9th in terms of assets in the ranking of banking players in Romania, as of December 2018.

OTP Group has more than 70 years of activity in the financial sector in Central and Eastern Europe, while the Romanian subsidiary has marked 15 years of presence in the local market. Promoting innovation, stable growth and integrated financial services, OTP Group has become a dominant player in the Central and Eastern European market and is considered an important banking group even on a European scale. The community of about 36 thousand employees serves nearly 19 million customers daily in 12 countries.